It's possible to have the highest FICO score in the world. This score is an indicator of creditworthiness. It is calculated using statistics on loan defaults. It can vary from person-to-person, but regardless of the number, it doesn't necessarily mean that your credit score is high.

Silent Generation

The Silent Generation, an older cohort of consumers has the highest average score for credit. They have a better credit score than other groups because they have been managing credit for longer periods of time. These people also have lower credit card balances and less credit cards.

They are also more financially stable as they have more years of experience and will likely retire. They also have higher investment income so are less likely be dependent on their paychecks. This is why they tend to have higher average scores than younger people.

Mississippi

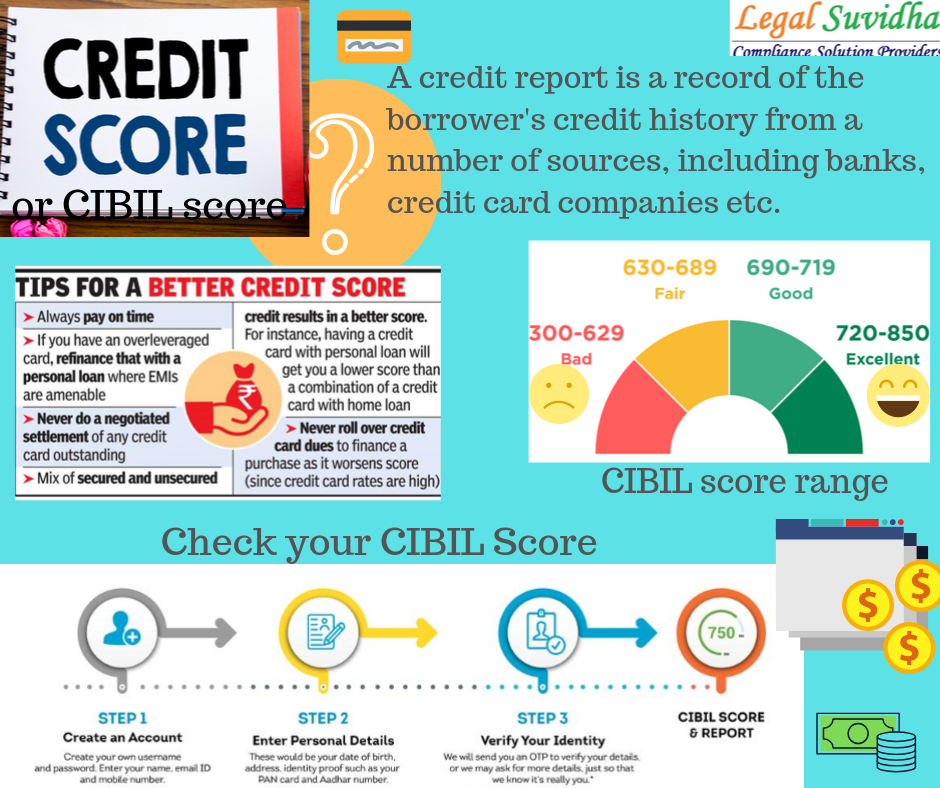

The average credit score across the United States of 680 is considered good, while the average Mississippi resident has a credit score that is within the "good” category. However, the average American still carries an average of 2.6 store cards and three regular credit cards. Fortunately, Americans are carrying less total debt and credit card debt than they did 10 years ago.

The good news is that Mississippi isn't the only state with a low credit score. Mississippi's average credit score is 675. This is eight points higher than the previous year. Although this is not good news for Magnolia residents, it is still significantly above the national average.

Millennials

Credit scores are affected in many ways, including the length of your credit history. Although the average millennial has a fico rating of 670, there are still risks. In fact, one study found that almost a third of the millennial population was turned down for a financial product in 2020. This statistic however motivated lenders to tighten requirements.

The average credit score of all generations has increased over the past few years. However, Millennials' credit score grew the most between 2019-2021. Their average score went up from 648 % to 667 %. The average score dropped slightly after that. The Silent Generation however, saw a modest decline with their score falling from 730-727. Higher credit scores can help you get lower-interest loans or secure a place to call your own.

Older Americans

FICO data has shown that credit scores among older Americans are the highest during their late-60s. Their FICO(r) Scores increase by more than twenty points in this age group. This is significant because they are more likely to have older accounts and a history of making payments. Many 60 year-olds have repaid their debt.

This is why their FICO(r score) is the highest among seniors. The score of younger consumers decreases over a ten year period, while the score of older consumers increases. In fact, between the ages 20 and 30, the average FICO(r), score among consumers in their 20s fell by 11 points. The score increase was higher in older Americans however, who had more debt as their parents.