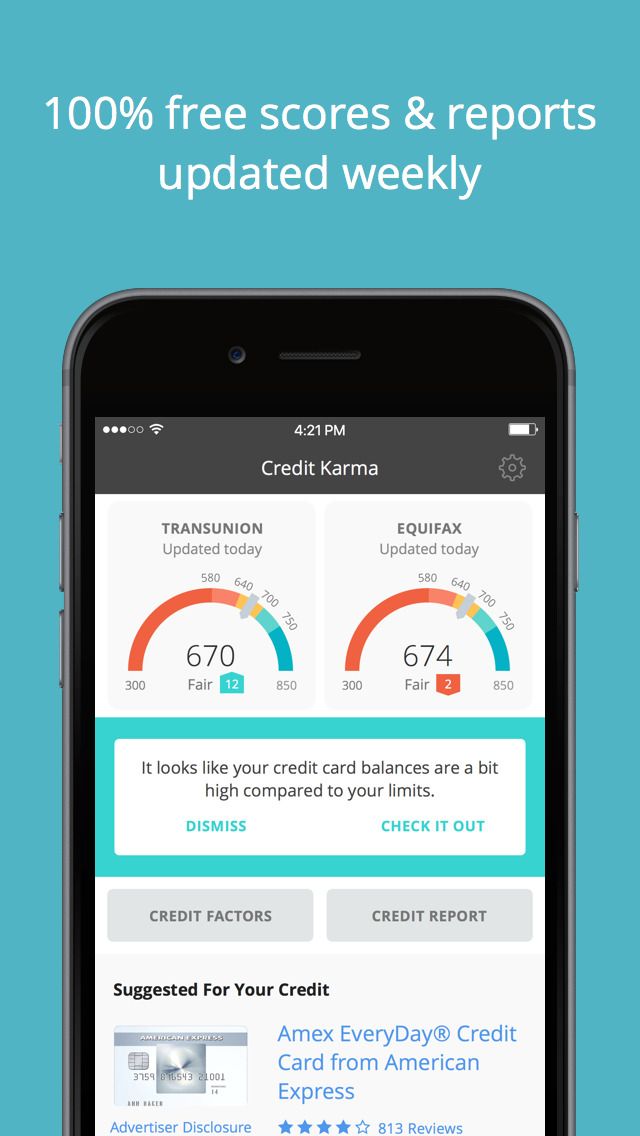

VantageScore is the American credit bureaus' consumer credit scoring system. VantageScore Solutions, LLC, an independent company, manages the model. It was established in 2006. VantageScore was jointly owned by the three bureaus since its inception in 2006. It's a free, anonymous tool that allows consumers to determine their creditworthiness.

VantageScore 3.0

VantageScore 30.0 is a credit scoring tool that differs from FICO. Although it is different from FICO in certain ways, the core principles are the same. These principles include paying all your bills on-time, limiting new credit, keeping your credit utilization low, and not allowing you to open any new accounts. These strategies will help you to improve your credit score.

Payment history is the biggest factor in VantageScore 3.0 credit scores. This is usually expressed as a percentage. Late or missed payments can seriously impact your credit score. Lenders would like to see proof that you have used credit responsibly for a long time.

Credit mix

A credit mix score refers to a credit score that takes into account several factors. One of these factors is payment history. In the calculation, it is also important to consider how long you have had credit accounts. Another factor is the mix of your credit accounts, including installments and revolving lines of credit. Your credit score will improve if you have a healthy credit mix.

The credit mix account for 10% of the consumer's FICO Score. This factor takes into account several types of credit accounts, such as lines of credit cards, and combines them to produce the VantageScore. A healthy credit mix includes both revolving and installment accounts.

Credit utilization

Many factors can affect your credit score, including how much debt you have. Multiple credit cards can be granted by lenders to lower your utilization ratio. The age of your credit card is another factor. You may find it difficult to manage your spending when you have too many credit card accounts. Also, adding new lines to your credit report can ding your score.

When it comes credit utilization, it is important to know the difference between per-card and total usage. Per-card use is the amount of credit that you have available compared to your total card balance. Total utilization reflects the amount of credit you're using compared to the amount of credit you have available. The better your credit score, the lower your overall utilization.

Public records

A person's credit score can be affected by public credit records. They are typically regarded as a very serious event that could significantly lower a person’s overall credit score. But public records are not all that credit reports can include. Public records include judgments and taxliens. Bankruptcy means that a person has defaulted on his or her credit obligations.