There are many credit cards on offer today. There are three types of credit cards available to consumers today: unsecured cards, rewards credit, and store cards. For people with bad credit, there are options. Discover which credit card is right to you. Each type of credit card offers a different set of perks. Make sure you carefully read the terms of your new credit cards to get the most out of them.

Rewards credit cards

You can get cash back with rewards credit cards. These cards allow you to earn cash back or points as well as travel miles. A substantial amount of money can be refunded if you pay your monthly balance. Many reward credit card cards come with generous welcome bonuses, as well many other benefits. They also come with cost-saving purchase coverages. These cards typically have higher interest rate than other types. To determine which rewards card is right for you, it's important to understand your financial situation and spending habits.

Rewards credit cards are best suited for consumers with excellent to good credit. However, they come with annual fees, which can be expensive and may negate any rewards you earn. The best rewards cards are those that fit your spending habits, and don't cost too much.

Secured credit cards

Unsecured credit credit cards can be more flexible and offer higher spending caps than secured credit. These cards don't require a security deposit and have credit limits up to thousands of dollars. For an unsecured credit card, you will need to have a steady income source and clean credit. The bill must be paid in full each billing cycle or you will be charged interest.

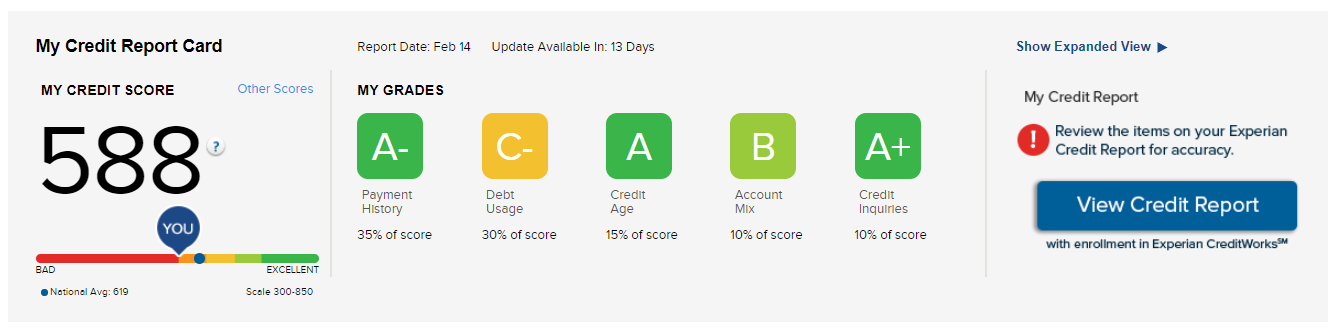

An unsecured credit card may be available to you if your credit rating is fair or poor. You can get an unsecured credit card with a credit score between 580-669, depending on which credit scoring model you use. You can raise your credit score by using your credit responsibly.

There are many options for unsecured credit cards. There are three types of unsecured credit cards: cash back cards, student cards, and travel reward cards. An unsecured credit card might be the right choice for you, depending on your spending habits.

Shop credit cards

The store credit cards are revolving credit lines you can use for purchases in the store. These cards are available from retailers who work with banks to encourage customers pay in advance and spread the cost over time. These cards are convenient for consumers, because you can use them anywhere that accepts credit cards.

While store credit cards may seem like a good option to build your credit, they have some drawbacks. First, the credit limit is usually low. The maximum amount you can spend is usually $300 to $500. It is easy to spend too much in one day. While store credit cards are convenient for those who have never used credit cards before, they can quickly damage your credit history.

One drawback to store credit cards is the restriction that they can only be used at stores where you have a credit account. You can usually get a discount of 5% or more on your purchases. Some of them offer rewards dollars which make future purchases much easier. Some store credit accounts are also members of payment networks such Visa and Mastercard.