A credit score is required for many things. You can still build credit even if your credit score is not great. There are many methods to start building credit. These include automatic payments, secured credit cards and rent reporting. These methods will quickly help you improve your score.

Rent reporting

Rent reporting is a great solution if your rent payments have been going on for too long and you don't have credit history. It is easy and free to report your payments to credit bureaus. Additionally, you can see a history and avoid late fees.

Rent reporting helps you establish a positive rental history and improve your credit score. Your rental payments are also considered alternative credit data. These rental payments won't be included in your FICO(r), but credit score models consider rent payments, utility bills and other non-traditional debts. A positive rental history is a great asset to lending institutions that use scoring models.

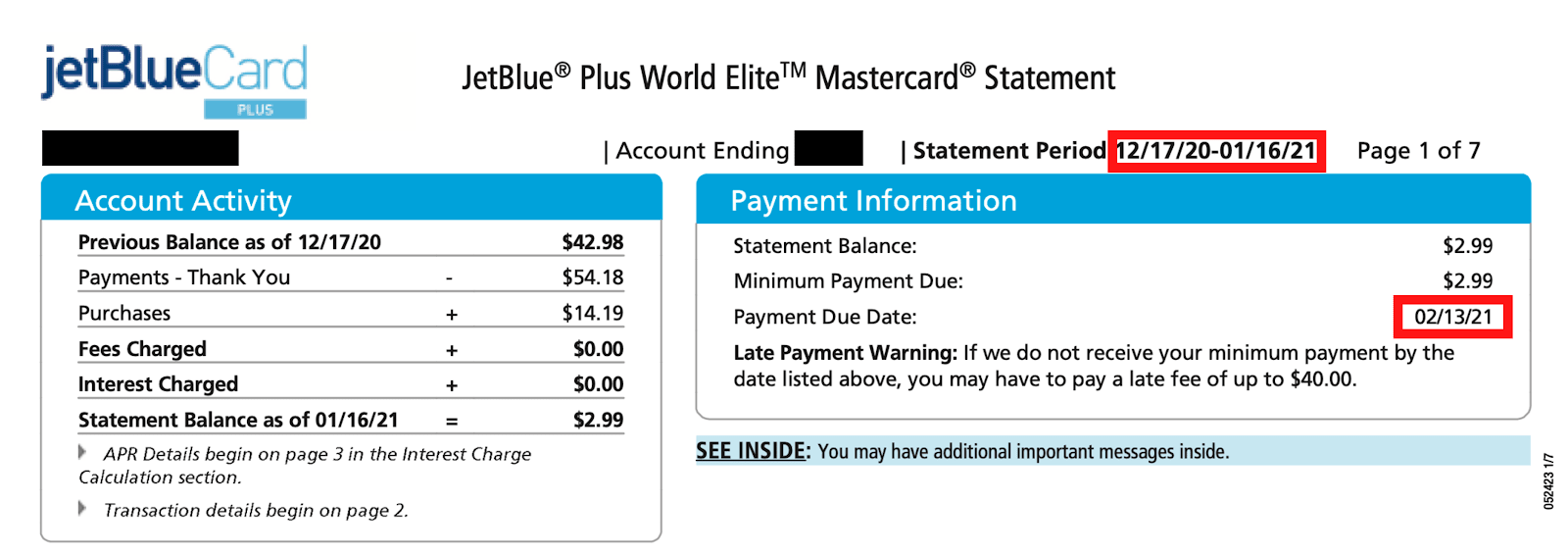

Automatic payments

You can set up automatic payments from your bank account to make sure you pay your bills on time every month. To allow the credit card company electronically withdraw funds from your checking account, you will need to give the details of the checking account. This information can be done via the credit-card's online portal. This is usually found under the Payments section.

Your credit score is based on your ability to pay on time. Autopay will ensure you never miss a single payment. You can set an alarm to remind your self to pay your bills promptly. It's important you pay your bills on time.

Secured credit cards

Secured credit cards offer a great opportunity for people to begin building credit. These cards don't require a credit check and often have no minimum credit score requirement. The credit limit on these cards is usually equal to the deposit amount, making them not suitable for high-spending customers. This is why it's best not to use them.

For a secured credit card, you will need to make a deposit equal the card's maximum credit limit. This deposit is often returned after you have paid your balance. You can also add more funds to your deposit to increase the utilization ratio. Once you have made the deposit, it is possible to start making purchases. The issuer can take your deposit if the payments are not made on time.

Applying for a credit line

It can be challenging to establish credit from scratch. You might have trouble getting a loan, a card, or an apartment without a credit record. To be eligible for these, lenders will require proof that your ability to make responsible monthly payments. You can easily check your credit score online. This will show you the factors that are affecting your credit score and what you could do to improve it. You can also apply to a secured credit or become an authorized card user.

It is possible to build credit without having to start from scratch. Using a credit card responsibly is one of the most effective ways to boost your score.

Applying to a Credit Card

There are many benefits to applying for credit cards to build credit. High credit limits allow you to build your credit faster. A credit card with high credit limits can allow you to enjoy lower credit utilization rates, which can increase your credit score. You won't be able to disclose your credit limit until you have been approved for credit cards with high credit limitations. Secured credit cards require a deposit to increase your credit limit. You may not be able to deposit $200 or more.

Unauthorized users should not be added to your credit card. Ask your credit card issuer whether they report these individuals to credit bureaus. Before adding the authorized user to your account, it is necessary to make an agreement with them. Unauthorized users will be responsible for paying a portion of the balance if they make purchases using the card.