Discover is a credit company that offers a range of credit cards. They are specifically designed to improve and repair your credit. They also offer rewards programs that can help you earn cash back and miles for travel. Learn more information about Discover credit cards. Discover can be used even without Facebook. Its privacy policies as well as terms of service are independent from Facebook. They are available before you sign up.

Discover is a credit union

Discover is a top credit company offering a wide range of credit cards. There are many cards that offer no annual fee, and they have strong rewards programs. These cards are a great way of earning cash back and turning your spending into a vacation. They also help build your credit scores. Discover employs more than 17,000 people and will have a net income of $5.4 Billion by 2021.

The shares of Discover Financial have risen more than 500% since the financial crisis. They are one of the top performing financial stocks in the last decade. Discover Financial stock is behind its competitors, and the market as a whole, but it has performed well over the last year.

It has a variety of credit cards that can be used to build and reestablish credit.

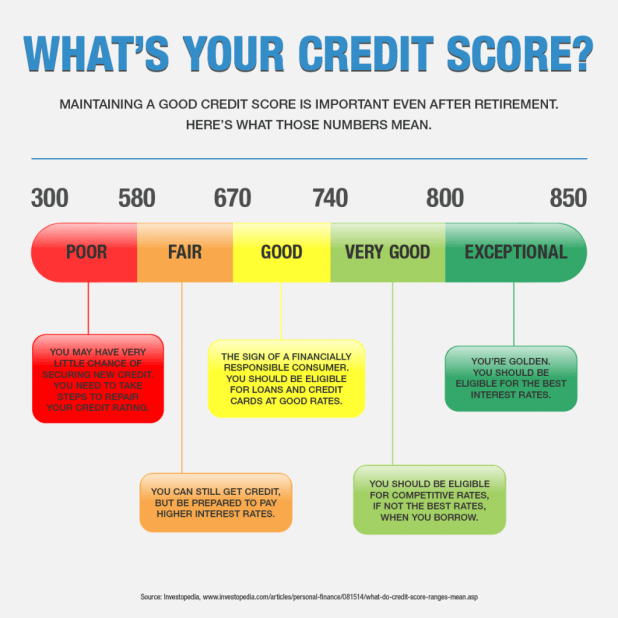

Poor credit may make it difficult to apply for credit cards with high limits or no credit limits. A better option is to take a credit card with a lower balance and build credit over time by making timely payments on time. This will improve your credit utilization and payment history. You should wait for a few months if you don't have a lot of credit history before you apply for a secured loan. This will allow you to improve your credit score and qualify for an unsecured credit card.

Discover has a number of credit cards that you can choose from, including a secured one that requires a deposit. This card is for people who need to build credit or rebuild their credit and don't want to risk their assets. A security deposit can be cumbersome, but the Discover it(r), Secured Credit Card has an option that allows you to make a refundable deposit. This deposit will be returned once your card has been paid off.

It also offers cash back rewards

Discover offers cash back rewards to credit card users who spend at least $500 a year in certain categories. The cash back rewards are based on the category and range between 1% and 5%. In addition, cardholders can set up email alerts or calendar reminders to remind them to activate bonus categories. The cash back reward for purchases that are not in the bonus category is also 1%

Discover does not charge late fees like other credit card companies. It also doesn't charge the penalty APR for any subsequent late payments. This is one of very few credit cards that offers this kind of benefit. The Discover card offers another benefit: it will match any cash back rewards earned in the first one year. This means you can receive as much cash as you wish, as long you are responsible with your card.

It has miles of travel potential

The Discover card is an excellent way to earn miles for traveling. The best part about the Discover card is that you can use your points to purchase anything, from flights to hotels. You don't need to spend much to redeem your points. This makes it easier to pay for less expensive travel expenses. You can also redeem your miles to make charitable donations and purchase gift cards.

You will receive a generous welcome bonus with the Discover card that matches any miles earned during your first year. Spend three thousand dollars on this card and you can earn up to $700 for travel. The card also offers 1.5 miles per dollar which is great news for frequent travelers. The card doesn't require you to keep track of rotating categories. You can earn miles any time, anyplace.