It is important to know what your credit score is and what you can do about it. Get a free copy your credit report. Then you can check your score on a regular basis to assess how it is going. Also, be aware of any changes that may occur to your credit score.

Free credit report

Go to the official site and fill out a short form to receive a free credit check. You will be asked to fill out some basic information, including your name, date, birth, SSN and current address. Other personal information might also be required by companies. Once you have completed all required information, you can begin the process of requesting credit reports.

Your free credit report can take up to seven days to arrive. It is best that you request a copy immediately. But, it is also important to be patient. Although processing your request can take up a maximum of fifteen days, you should be able to receive your report within this time.

Request a copy of the credit report

A copy of your credit file will provide insight into what factors affect your credit score. This information is useful for applying for a loan, or to obtain insurance policies. If you have poor credit, lenders might have declined you. Your credit report will detail any inquiries made in the past two years.

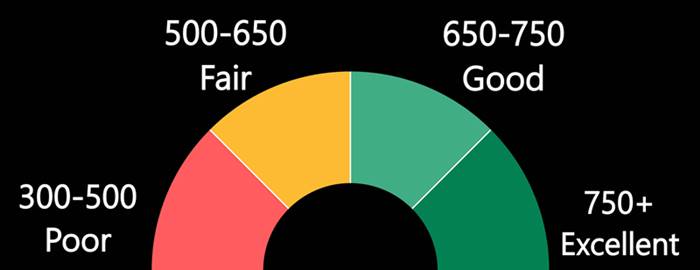

Credit score is a number of three-digit numbers that are calculated using data from your credit reports. It can range between 300 and 850. Each bureau uses a different formula in determining your credit score. It's a measure of your likelihood to repay a loan.

Your credit score should be checked regularly

If your financial situation is good, you will know that regular credit scores checks are important to keep your finances on the right track. NerdWallet has found that two thirds of adults fail to check their credit report each year. You can avoid identity theft by keeping track of your credit report. Information about your past addresses and employers is included in your credit report.

It is a good habit to check your credit score frequently. This will help you avoid identity theft. This problem arises when someone impersonates another person and steals vital information, such as a social security number. The information is then used to make financial transactions that use the identity of that person. A good credit score can help you protect yourself from this potential thief and make sure your financial future is secure.

Importance of having a good credit score

Good credit scores can help you unlock many financial doors. Good credit scores will allow you to qualify for lower interest rate loans. Your ability to find employment also depends on your credit score. If you have a high credit rating, it is more likely that you will be hired by an excellent company.

A good credit score is important when renting an apartment or buying a house. This is because lenders and landlords will be able to see your debt history and determine whether or not you're a good risk. A good score and timely payments will help you get a better rate on your mortgage.