If you're wondering, "How can I improve my credit score?" This article will help you. There are a few easy steps you can take in order to improve your credit score. You can get a copy of the credit report, correct errors, and pay off your credit card debt.

Request a copy of the credit report

One of the most important steps to improving your credit score is to obtain a copy of credit reports. It will also help you avoid mistakes that can hurt your score. If you are not satisfied with the information, you may try to dispute it with the credit bureaus. If the bureaus are willing for them to investigate, they can remove incorrect information from your credit file within 30 day. In addition, by making timely payments on your existing accounts, you can improve your score.

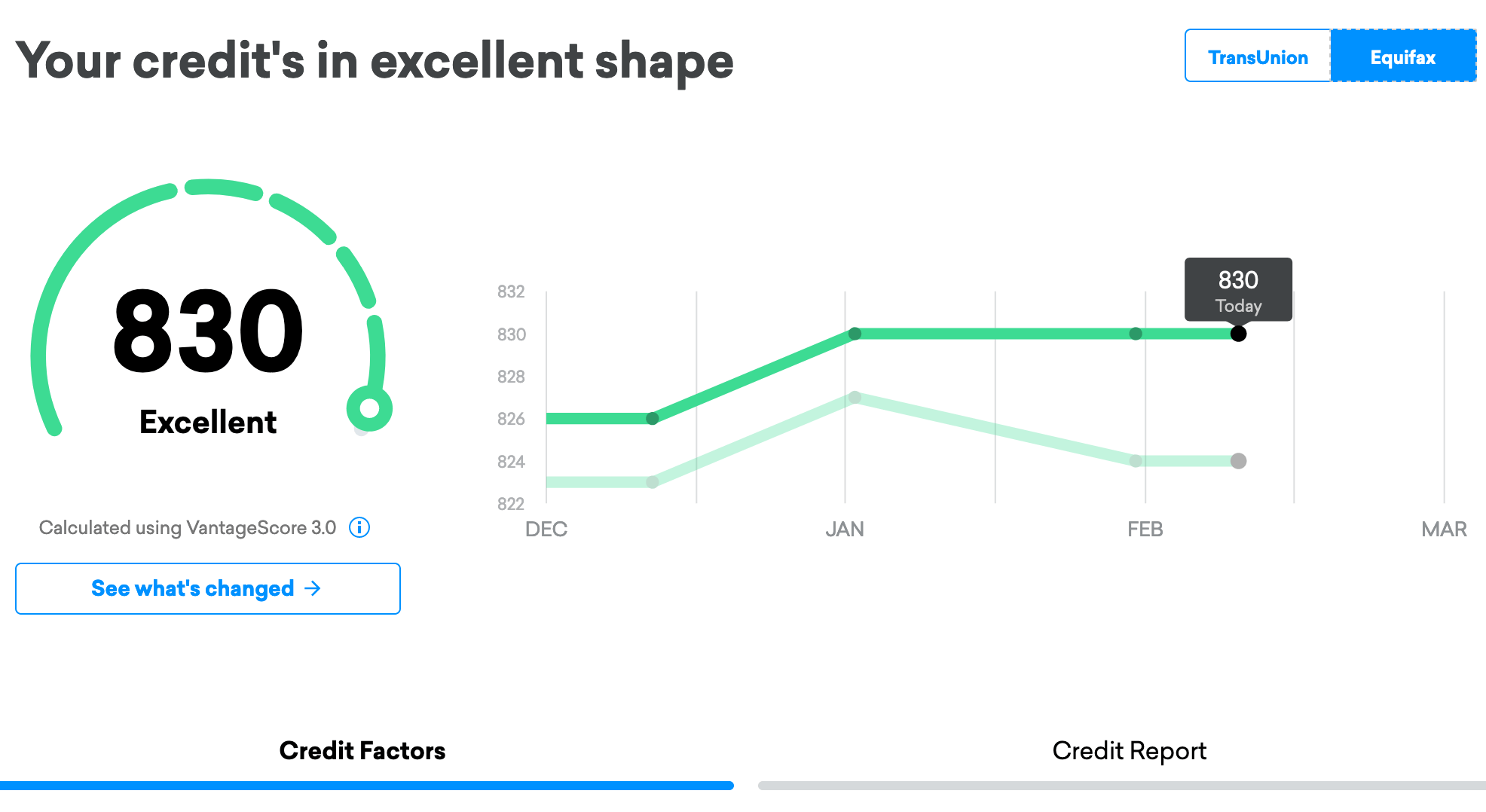

Free credit reports are available online or by mail, and you can get one in a day. Remember that different credit reporting agencies have different information. You might have more than one report. However, you can request a free score from any or all of these agencies. It is important to note that the scores might not be the same from each.

Applying for a new credit card

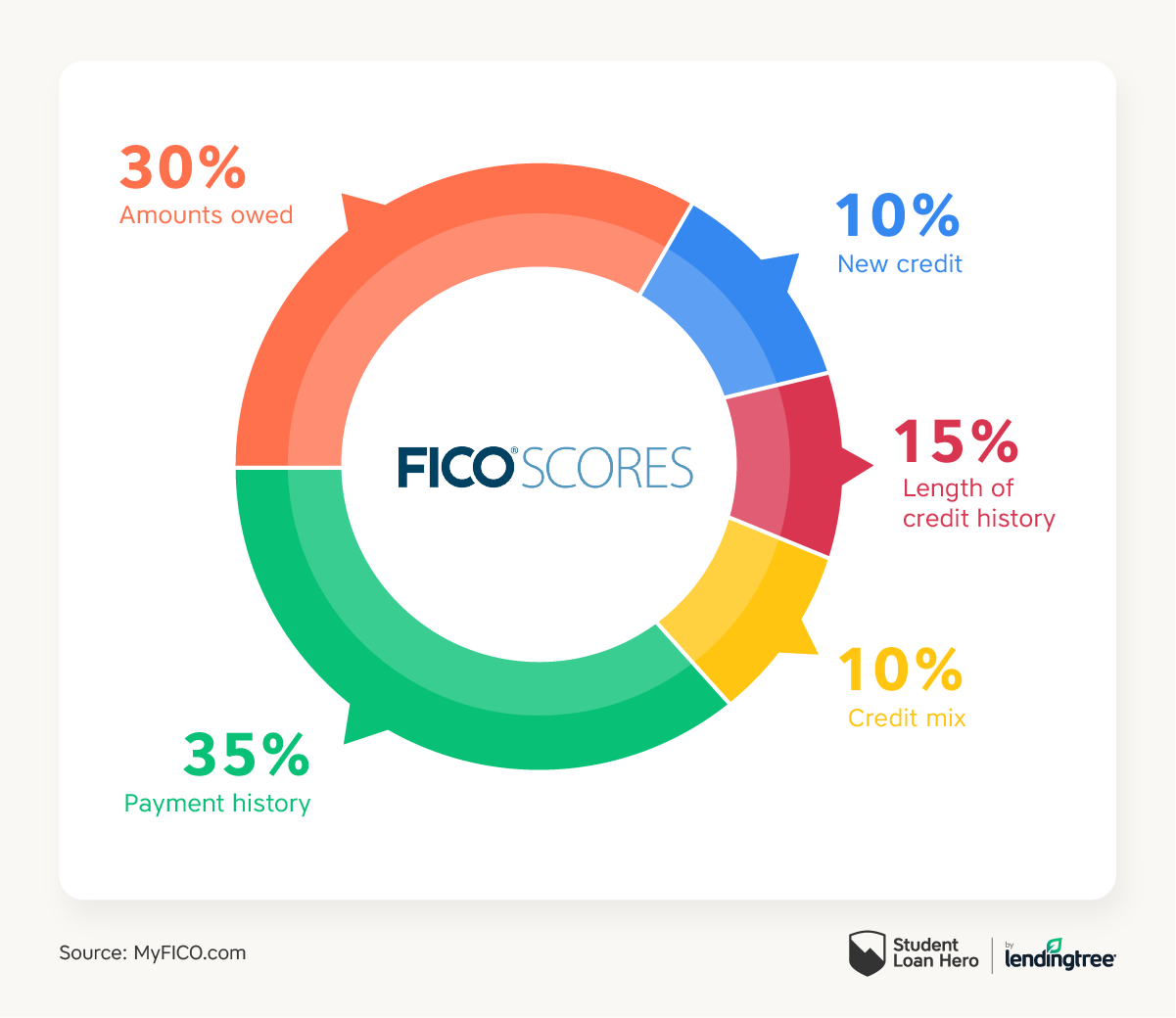

While a new card can increase your credit score, it can also be detrimental. It is important that you pay your bills promptly and don't accumulate high balances. Credit scores are determined by many factors. The most important one is your payment history. Credit scores that are high can help you qualify for top credit cards.

The credit utilization ratio (or the ratio between credit balances and available credit) is one of the most important factors that affect your credit score. A low credit utilization ratio is important as it shows you have control over your credit. Try to keep your total card balances below 30%. You can also improve your credit score by maintaining small balances on older cards. It is also a good idea to make automatic payments on these cards.

How to pay off credit card debt

Paying off credit card debt is a great way to raise your credit score. You will see an even greater impact if you have bad credit. Your score will increase if you pay your bills on time. If you pay down your debt, it will make it possible to borrow at the most attractive interest rates.

Paying off high-limit credit cards can also help improve credit scores. You can improve your credit score by paying off high-limit cards. This will reduce the amount of debt that you have. You can reduce your overall debt by paying off $500 on a card that has a limit of $1,000. You will also see a decrease in your credit utilization ratio. This will positively impact your credit score.

Correcting credit reports errors

There are many ways to correct credit reporting errors. One option is to contact the credit bureaus directly. You can either file a dispute online, or you can mail it. Your dispute will be reviewed by the credit bureaus. After reviewing your dispute and contacting you for further discussion,

There is no cost to correct errors. But it is essential to ensure that you correct any errors you find in your report. This will improve your credit score. Although most of these errors will not cause any damage, 25% could result in denial of credit and additional costs. These errors can be challenged through the Fair Credit Reporting Act. Credit report agencies must fix them within 30 days.

Requesting a credit limit increase

If you're thinking about asking for an increase on your credit card, you need to understand how the process works and how to make the request in the best possible way. You must first contact your credit card issuer directly. You can either call them directly or complete the online application. Customer service representatives should be able help you understand the process, and answer any questions. When submitting your request, the key is to keep calm and professional.

The second requirement is to prove you are responsible. This means that you never miss a payment and never make purchases above your credit limit. It is important that you make additional payments each month. Your credit limit may be increased if you can show a positive track-record.