Teenagers are still learning about credit. Parents should give them the tools and financial education that they need. It is a wonderful gift to give financial responsibility and financial education that they will carry with them for the rest of their lives. Good credit will provide financial security for your teen. Here are some suggestions to get your teen started.

Credit cards: Authorized users can be added to credit cards by adding a minor

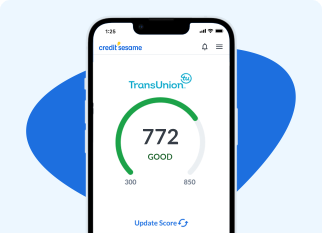

It can be a great way for children to get credit started before they reach 18 years of age. Credit reporting agencies will be notified by major issuers whenever an authorized user makes payment. The child is entitled to credit for any payments made, even if they are not the account's owner. This improves their credit score and can help them get better cards later in life.

You should remember that minors under 18 cannot open credit cards. However, if you add your child to the authorized user list, they will be eligible for credit card benefits. Authorized users are able to get their own card, which is tied to the primary cardholder's account.

One or more accounts can be managed

Managing one or two accounts to build credit early in a teenager's life is a great way to demonstrate your child's maturity and responsibility. Your child will learn valuable money skills by putting a small amount into a savings or checking account. Your child will also learn to distinguish between a necessity purchase and a luxury purchase by letting him use his debit card.

Many credit unions and banks offer checking accounts for teenagers. These accounts have lower fees than standard ones. By opening a checking account for your teen, you can teach your child about money management and how to reconcile accounts. It is possible to become a cosigner of the account for your teen, which will make it easier for you to monitor their spending.

Spending and budgeting responsibly

It's not too late to help teenagers learn how budgeting and spending responsibly. Start by getting a debitcard, which allows them the freedom to spend their own money. Credit cards, on the other hand, are loans from the credit card issuers, and late payments are charged interest. It is crucial to save money in order to maintain a healthy financial future. Budgeting can be a good way of limiting spending.

Setting goals is an excellent way to encourage your teen to think about both long-term and shorter-term goals. Short-term goals can be saved for a car or worked towards a career.

Protect your identity from identity theft

Teen identity theft can be avoided by being cautious with online social media platforms. Teens aren't afraid to share personal information with friends. Status updates can be found online. This makes it easy for identity thieves to gain valuable data over time and then use it to create false identities. Online updates can reveal whereabouts and the address of a teenage's home.

Although a teenager might not be aware of it, their information could still be used to commit identity theft. Thieves frequently target young people who have clean credit reports. Because they don't regularly review their credit reports, they are more likely to be targeted. You can easily find teens' social security numbers online. Even close friends and family members could be identity thieves.