There are many ways to increase your credit score. You need to raise your credit score to be able to access many important financial services. However, it can be confusing to know where you should start. There are a few ways that you can quickly build your credit. These include making timely payments and applying for credit cards. You can also borrow money to get started building credit.

Making timely payments

One of the most important factors in determining your credit score is your payment history. Your payment history is responsible for 35 percent your credit score. Therefore, it is crucial to make timely payments. The easiest way to achieve this is to set up automatic payments for all your bills. They automatically debit your bank account from the due date. That way, you don't have to remember to set aside any extra money to cover the payment.

You can also build credit by getting a personal loan. Even though this loan may seem daunting, it can be very useful in helping to establish credit history. It is important to limit the amount of money you borrow to what you can pay back. Do not miss any payments or you will lose your credit score.

A secured credit card

Getting a secured credit card is a good way to build your credit. This card requires you to provide collateral in the form of a cash deposit. In return, the card is allowed to be used for purchases. If you fail to pay your dues, the issuer could withhold your deposit.

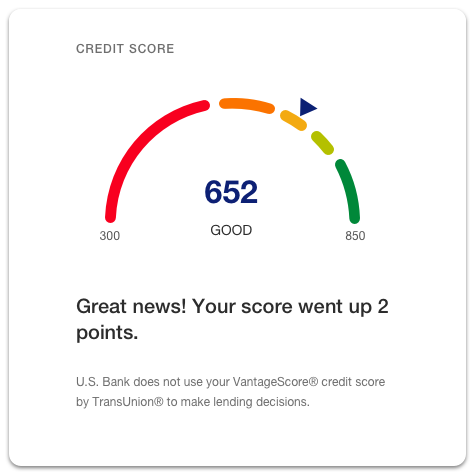

Your credit score will increase quickly if you get a secured line of credit. In fact, this progress could happen quickly if you make your payments on time and keep your balance low. If your credit history is solid enough, you might be eligible for an unsecured card with lower fees or better rewards.

Multiple credit cards

Multiple credit cards are a great strategy for building credit. Most credit card applications require the same information as for your birth date and Social Security number. You'll then go through several stages, including a credit check. Here are some points to remember while applying for credit cards. First, you should be ready to provide as much information possible.

While multiple credit card applications can improve your credit score, they may not be the best ways to build it. You should not make too many requests or have high balances. This could affect your credit score. A higher utilization ratio could result in you accumulating more debt than you can manage.

Take out a loan to improve credit

People who want to improve their credit score can get loans from many banks and credit unions. These loans must be reported to credit bureaus. You should not borrow more than you are able to pay back. If you are building credit through a personal loan, it is important to keep up with your payments. Your credit score can be damaged if you miss or make late payments.

A high credit score will make it easier for you to obtain credit and receive it at the highest rates. Although credit building can be complicated, it is possible. Building credit takes time. It's important to keep track of your progress and make timely payments in order to keep your score up.