A credit builder is a great tool to improve your credit and make it easier to obtain other loans, such a mortgage or a card with a favorable interest. Before applying for a credit-builder loan, there are a few things people need to be aware of. Prior credit problems, such as bounced check, should be avoided. This will negatively impact credit scores. It is also important to avoid making late payments because they will result in interest charges and will reduce your credit score.

The best way to build credit is with self-credit builders loans

A self-credit builder loan allows the borrower to build credit without a hard inquiry on their credit report. They choose a term that corresponds to the amount of funds they want to borrow and make monthly payments until they reach the amount they want. When the term ends, the money is released to the borrower. This process can take up to two weeks. The majority of institutions won't allow borrowers to borrow more than one builder loan simultaneously.

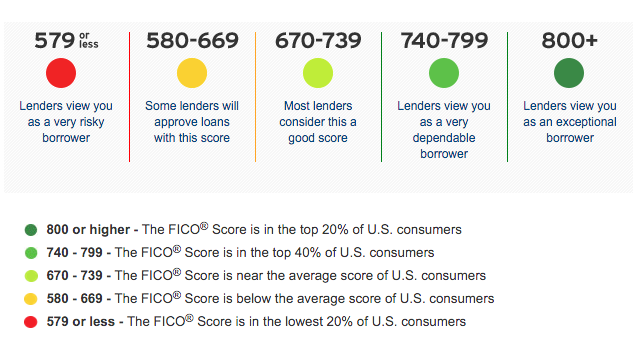

For those with poor credit or no credit, a self-credit building loan may be a great option. Since payment history makes up three-fifths of your FICO credit score, it is essential that you make payments on time to build a positive credit history. Self-credit building loans can be affordable, quick to obtain and don’t require credit union qualifications. In some cases, you can boost your credit score for as little as $25 a month with a self-credit builder loan.

They demand that you repay the loan fully

A credit loan builder, a short-term loan that helps you build credit over time, is what a credit loan builder looks like. This type of loan usually requires that you make monthly payments on time. The lender will release the funds to your bank account once the loan is fully repaid. As long as you make all of your payments on time, your credit score will improve over time.

While the amount you borrow will be deposited into your bank account, you can't access the money until you repay the loan. The financial institution, credit union, online lender, or other lender holds the money. It can be saved or placed in a CD account. You may have to pay an initial application fee and an administration fee, but once you have established a satisfactory repayment history, you can access your money at any time.

They are simple to qualify for

Credit loan builders are a type installment loan that will help you improve your credit score. This type of loan is designed to improve your credit score as well as lengthen your credit history. Petal1 can be a credit builder lender. Petal1 accepts your application based on both your bank history and credit score.

A credit loan builder is usually a small loan for a few hundred to several thousand dollars. The money borrowed is placed into a savings account and the borrower pays off the loan every month. These payments will be reported by the lender to the credit bureaus.

They offer low interest rates

People looking to build their credit are well served by a credit loan builder. These loans offer lower interest rates and carry less risk than traditional personal loans. They are also easier to obtain, and can be more affordable for those with low credit scores. These loans are available at many banks and credit cooperatives. If you have an existing account, you can inquire about these loans or search online for them.

Keep in mind that the borrower's past payment history is a key factor in determining their FICO credit score. Late payments can have a negative effect on a borrower’s credit score. However, timely payments will improve a borrower’s score. Consequently, it is important to ensure that you can comfortably make the monthly payments. You can either set-up auto-pay from your primary bank account or use a phone reminder to remind you of payments.