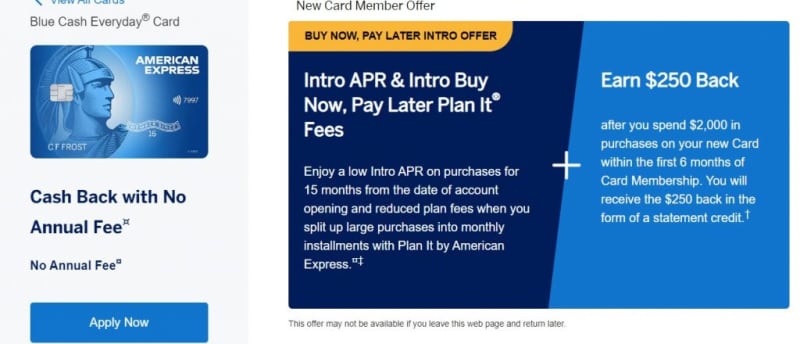

Credit cards can be a great tool for building credit. This card is great since it does not have an annual charge and reports to all three major credit companies monthly. You can apply even if you have little credit history. This card's biggest disadvantage is its high interest rate. It should be avoided if you are trying to increase credit lines. There are many credit card options available for people with low credit scores.

Credit building

You don't need to spend a lot of time building your credit. The right card will help you earn points for good payment history and a low credit utilization rate. If you are a frequent shopper in shops, a shop card may be an option. These cards are ideal for building credit because they offer rewards as well as lower interest rates. Students can get student credit cards. It is important to be careful about building credit. If you do, you may end up paying more than you need.

Credit cards

Credit cards make it easy to buy things and can help you build credit. They should not be used for items that you cannot afford to purchase in cash, or that you don't need immediately. Plan to pay your monthly balance and be aware of the fees associated using the card. A late payment fee of $29 is the national average. An over-limit fee of $39 can prove costly. It is possible to keep your debit card active while you work on paying off your debt.

Paying on time

Paying on time is the best way to improve credit scores. A single late payment can damage your credit for seven years. For a better experience, you can ask your friends or family for money or borrow money from your savings account. Late payments could also impact your credit score. Credit scoring systems look at your credit limit, as well the balance on your card. Keeping your balance to 30 percent or less will help your credit score.

Credit limit increases should be avoided

In many cases, you can increase your credit limit, but be sure to request a limit that is at least twice as much as your current one. You may be denied if you don't plan to exceed your credit limit. Also, it is important to consider your spending habits before applying for a higher credit line. This extra credit can lead to higher interest rates, higher minimum payments, and even higher charges.

How to get a credit card approved

Getting approved for a credit card that helps you build your credit may not be easy. It can be difficult because of several factors. A stable job is a prerequisite for you to be eligible. It is possible that you will have to wait several months before being approved. If you're patient, you can get approved. These steps will help you get approved.

Secured credit cards

A secured credit card is a great way to build credit. The utilization rate of a credit card accounts for 35% of your overall score. Keep your balances below 10% to increase your score. Your credit score will improve if you make on-time payments. This is because time is a credit card's greatest ally. A secured credit card will not only help you build your credit score quickly but it can also help you to repair your credit history.